Don’t worry if you are sitting there asking yourself, “What actually is Professional Indemnity Insurance?”. It is a question asked a lot. So much so, if you just google the what it is, Google has about 22,400,000 results for that exact expression.

So, you definitely are not alone. This guide is try help you navigate Pi Cover. Understand some of the jargon and help you get the most out of your professional indemnity insurance.

What is Professional Indemnity Insurance?

Professional Indemnity Insurance is an important type of business insurance.

It is particularly prevalent and important for professionals who provide advice for a living. It is designed to help protect professionals and companies in the event of a claim being made against them.

This claim could be for an error or omission while performing their professional duties or providing professional advice.

If a mistake or omission is made while you (or your company) is providing professional services and the result is that a third party (i.e. your customer) suffers a financial loss or injury, the third party could take legal action against you or your company.

Professional Indemnity Insurance seeks to not only protect your assets but also your reputation if this event were to occur.

If you want an easy way to understand Professional Indemnity Insurance check out our Professional Indemnity Insurance Info-graphic.

It can be known as Professional Indemnity Insurance, PI Cover, PI, Errors or Omission Insurance or E&O Insurance. It is most commonly known in Australia simply as Professional Indemnity Insurance.

Professional Indemnity Insurance is available for many professionals, see the list below for some of the professions with PII options available to them.

What does it cover?

Professional Indemnity Insurance covers the costs associated with any claims made against you due to an error, mistake or omissions made during the course of your work as a professional. A few examples are:

- A breach in contract. You may not achieve the original agreed deadline and your customer suffers a financial loss

- Mistakes while giving professional advice. Giving poor legal advice, medical malpractice or not assessing someone’s accounts properly

It generally works on a claims made basis, meaning it only covers claims made during periods of active cover.

Coverage does not cover criminal prosecution and does not always cover all forms of legal liability so it is important to always read you cover and if you have any questions, ask your broker.

Why do I need professional indemnity insurance?

As a qualified professional in any sector (from health practitioners, to engineers, to financial advisors) you have expertise and experience your clients do not have. Under Australian law that means they are legally entitled to expect that:

- You will deliver the services they pay for to the agreed quality and timescale.

- Any advice you provide will be accurate, complete and appropriate for their circumstances.

If something goes wrong and a client suffers any kind of financial loss because of work you’ve done for them or advice you’ve given, they can take legal action against you. If this happens, your legal costs plus the damages you may have to pay could run into the tens or even hundreds of thousands of dollars.

And if you’re found to be professionally negligent, clients can also sue you personally – so your personal assets and even your home could be at risk.

The cost of defending a claim can be more than just money.

The scariest part of this is that no matter how well you do your job, a client only has to believe that they have been wronged, or that you’re responsible for their losses, to file a professional negligence claim against you. Even if the claim is unfounded, and is eventually dismissed in court, your legal costs could still amount to many thousands.

Most forms of PI insurance will cover you for the cost of defending a legal claim, whether or not it is upheld, and for the damages you have to pay (up to the limit of your policy).

In some cases, your clients may even require you to have PI insurance cover.

Professional insurance doesn’t just protect you – it also safeguards your clients. After all, if something serious and expensive should happen to go wrong, their own livelihood could be at risk.

Many organisations, especially government agencies, will only deal with service providers who can show evidence that they have a minimum level of PI insurance cover in place.

Is professional indemnity insurance compulsory compulsory?

PI Insurance is often a condition of doing business. In many sectors, professional indemnity insurance is a basic requirement of operating in Australia.

A wide range of professionals, including legal and medical practitioners, architects, real estate agents and tax agents are legally required to have PI insurance in order to qualify for an operating licence.

Other professionals, including accountants and alternative health practitioners, are regulated by professional bodies that require their members to have adequate PI cover.

These laws and regulations are in place to protect both professionals and their customers, and to uphold service standards within high-risk industries where the consequences of a mistake could be extremely serious.

If you aren’t sure of your requirements get in touch with your governing body or speak to a broker.

What is required when I need to get professional indemnity insurance?

Due to the varying levels and professions covered it is best to speak to a broker and they can guide you through the process and will explain what you will need to get cover in place.

It can be very simple in a lot of cases but depending on the size or complexity of your business it can need a bit more attention from all parties to ensure the right cover is provided.

Most information is directly relating to you or your business and you will know inherently.

How much cover do I need?

There are many factors when considering how much cover you may need. In some cases, your professional governing body will give you guidance and sometimes minimum covers are required.

It’s always a good idea to get in touch with them and see if there are any minimums in place before finalising coverage.

It’s not always the amount of money or the scope of work you or your business practice, but the size of your customer base and the possible impact that could happen if something were to go wrong.

You may not be making much money on a specific piece of work but if something were to happen, the impact on your customer could be a lot greater. Or, how many people are relying on your work – it could be 1, it could be many.

This could also impact the possible outcome if an error or omission is made. Also, make sure you think about your largest client or contract.

It can be difficult to calculate exactly what cover you may need so it is always important to do your research, risk assess your own business, get in touch with your professional association and contact a broker to help you make your decision.

How do I get a quote?

To get a quote, you need to speak to a provider of professional indemnity insurance. To speak to a broker, put your details here and a broker will be in touch.

How long should I have professional indemnity insurance for?

Professional Indemnity Insurance is on what is a called a claims made basis. What this means is, it only covers you for claims made while you have active cover.

This means you should always consider having cover when you are providing professional services or advice.

There is also cover called ‘run off’ cover which is explained in more detail below and is available after active cover is no longer required.

How is the cost calculated?

Like many insurance products, the cost is calculated by the insurance provider using data around the risks associated with the product and the possible outcomes.

A lot of factors are taken into consideration and include but aren’t limited to:

The professional services you provide (i.e. the nature of your business)

The size of your organisation

The excess associated with the policy

Your claims history

Professional Indemnity vs. Public Liability. What’s theProfessional Indemnity vs. Public Liability. What’s the difference?

It is important to understand the differences between Professional Indemnity Insurance and Public Liability Insurance.

Professional Indemnity Insurance is designed to cover professionals when a claim may be made against them when professional services or advice is given and a mistake, error or omission is made leading to financial or physical impact on your customer.

Public Liability Insurance is designed to protect business that operate in a public place like a restaurant or bar with an outdoor area. It is designed to protect the business if bodily injury or property damages occurs while on your property.

For more information on public liability, have a look at the Australian Government business site.

Jargon and FAQ’s?

Jargon. The ultimate stitch up. Below is some words you may come across when arranging or reading a Professional Indemnity Insurance Policy and some helpful FAQ’s.

What Is Professional Indemnity Run Off Cover?

Run off cover provides protection for professionals when they have either ceased trading or sold their business.

While the business or professional may not be actively providing services any more, they can still be subject to claims for their activities and services when they were practicing.

Run off cover provides coverage for claims that would have been covered during the original period of insurance.

Speak to a broker today to ensure you are still covered after you cease trading.

What Is Automatic Reinstatement?

Automatic reinstatement is a provision in a policy stating that after a claim/loss has been paid out the policy will return to its original claim limit.

For example, assume a loss of $50,000.00 is paid out on a policy with a policy that has a $100,000.00 liability coverage.

Once the $50,000.00 is paid, the policy returns to its original coverage limit of $100,000.00 automatically (hence Automatic Reinstatement).

If you want automatic reinstatement be sure to inform your broke or insurer.

Additionally, always check your policy to ensure automatic reinstatement is on your policy if you want it, and how many times it can happen under the policy. If not, you may have to pay an additional premium to return the policy to its original cover limits.

What Is The Retroactive Date?

The retroactive date is the earliest date (generally in the past hence retroactive) that an event or circumstance can occur and be covered if a claim is made under the policy.

If you have been practicing already, you can sometimes negotiate a retroactive date to ensure policy protection on claims which have the potential to be made during this period.

What Is The Inception Date?

The inception date is the very first day your new policy is taken out. This isn’t to be confused with retroactive date as they are very different.

For example, if you were to change insurer, the day you take out your new policy will be that polices inception date, you may be able to negotiate a different inception date as you had previous coverage for that period.

What Is A Claims Made Policy?

Professional Indemnity Insurance works on what is called a claims made basis.

What this means is simply, an active policy must be in place when a claim is made against you or your business.

It can also be known as claims made and claims notified as you should notify your insurer as soon as you know about a claim being made against you no matter how big or small it may seem to you.

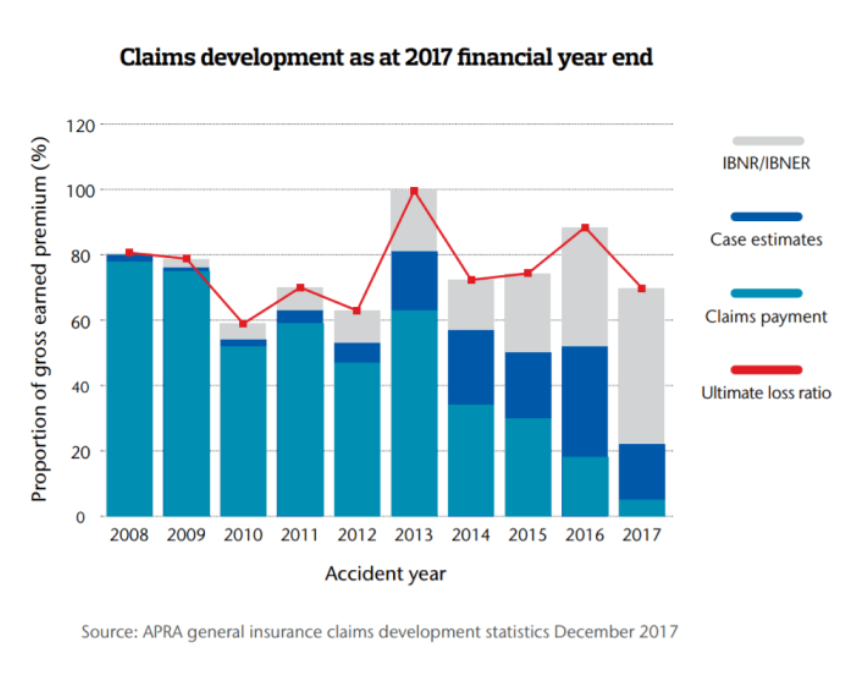

The image below courtesy of AON Australia gives you a visual insight into the way claims can change and swing due to the nature of a claims made policy.

The red line indicates the “ultimate loss ratio” which is the amount of money a insurer pays out VS the policy values they have charged their customers.

As you can see in 2013 the ultimate loss ratio was near that of the gross earned premiums. These loss ratios are one major factor that insurers consider when pricing your policy.

Can I Increase Or Decrease My Policy Limits?

Yes. If you need to increase or decrease your policy limits you need to get in touch with your insurance provider or insurance broker.

Always consider the changes before auctioning and consider all possible outcomes to ensure you will still be adequately covered.

When Should Claims Be Notified?

As soon as you know. No matter how big or small they may seem it is always important to tell your insurer as soon as you know.

Due to Professional Indemnity Insurance being a claims made policy, you should always keep your insurer informed to help if anything does arise from a claim.

Can I Make Changes To My Policy?

Yes. If you need to make any changes to your policy, it is best to get in touch with your insurer or insurance broker as soon as possible to amend or change the policy as required.

Depending on the change, there could also be an impact on the cost of your policy.

Who Is A ‘Professional’?

Who is a Professional has changed significantly in regards to Professional Indemnity Insurance over the years. Gone are the days of coverage only for traditional professionals like doctors, architects and engineers.

Modern coverage can be provided for professions from I.T Consultants to Yoga Instructors.

If you provide services or advice, consider getting Professional Indemnity Insurance.

What is “Limit Of Indemnity”?

The ‘Limit of Indemnity’ is the maximum amount an insurer will pay on the insureds behalf in regards to a claim that may be made. If the claim made exceeds the policy’s claim limit being made, the amount over the limit would not be covered.

It is a good idea to consider automatic reinstatement if multiple claims may be made in the period of the policies cover.

Always consider the limit you may want or need when you are finalising your policy and ensure you are comfortable with the amount covered.

What occupations are covered?

There any multiple insurers who provide Professional Indemnity Insurance in Australia.

There is some more information below on some of the Professions and Occupations that have PII Cover available.

If you can’t find what you are looking for there, put your details in our contact page and one of our network of preferred brokers will be in touch.

The Infographic

The Infographic

Getting Professional Indemnity Insurance has never been easier. Submit a quote request and one of our panel of brokers will be in touch. Don’t wait, get a quote today.